Long term debt funds invest in bonds with very long expiry periods. This period can be as long as 10 years. Most of the long term debt fund investment goes into government bonds.

Holdings of one of the famous long term debt fund : ICICI pru long term fund : http://www.moneycontrol.com/mutual-funds/icici-prudential-long-term-plan-direct-plan/portfolio-holdings/MPI2285

Long term debt fund can go up and down depending upon the yields of these bonds.

The net asset value of any long term debt fund will fall when yield of these 10 year government bond rise. These bonds are traded in bond market and can rise and fall due to variety of reasons:

1) Market sentiments: If inflation is rising or macro data are not coming out good. These bonds will grow attract higher yield and as a result your long term debt fund NAV will fall.

2) RBI policy: Any hike in monetary ratios(repo rate etc) will again increase the yield of 10 year bond yield and decrease ong term debt fund NAV.

To check the present and past yield of 10 year bond refer : https://www.bloomberg.com/quote/GIND10YR:IND

Showing posts with label mutual funds. Show all posts

Showing posts with label mutual funds. Show all posts

Saturday, May 26, 2018

Friday, December 29, 2017

Multibagger stocks for 2018

List of multibagger stocks for 2018 as per internet research :

This list is completely internet research based. Do your own analysis before investing.

1.

Grauer

and Weil

2.

Gokul

agro

3.

Vikas

Ecotech

4.

Kriti

Nutrients

5.

Pact

industry

6.

Bharatiya

Global

7.

Meghmani

Organi

8.

Ashok

Leyland

9.

Yes

Bank

10.Aries Agro

11.Sanwaria Agro

12.Exide Industry

13.Commercial Engineering

14.Madras Fertilizer

15.IL and FS

16.Morepen Lab

17.BF INVESTMENTS

18.STEL Holdings

19.Dewan Housing

20.PC Jeweller

21.Shakti Pumps

22.Syncom Formula

23.SATIN

CREDITCARE NETWORK LTD

24.MCX

25.CDSL

26.Icici Prudential

27.Dr Lal path labs

28.TATA MOTORS

29.M&M

30.Indraprastha

Gas Limited

31.Deepak fertilizers and petrochemicals

32.Rashtriya chemicals and fertilisers

33.Coal India

34.Rain industries

35.Edelweiss

36.Kolte patil developers

37.Apex frozen food

38.Elecon Engineering

39.Nagreeka Capital

40.Religare

41.Godrej Agrovet

42.Sintex plastics

43.Rain

44.UFO movies

45.Capacitˡe Infraprojects Limited (CIL)

46.FINEOTEX CHEMICALS

47.GRAUER AND WEIL

48.NITIN SPINNERS

49.PODDAR PIGMENTS

50.SHIVAM AUTOTECH

51.Ashoka Buildcon

52.Centuryply

53.Universal cables

54.KEI Industries

Thursday, December 28, 2017

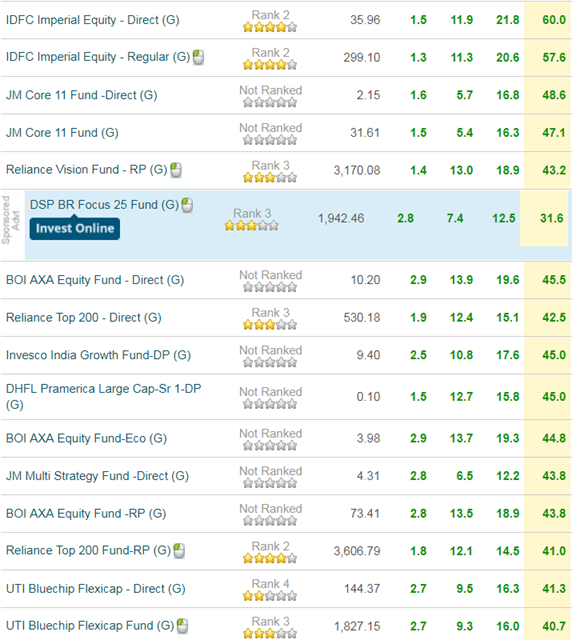

Best performing mutual funds for year 2017.

Best performing mutual funds for year 2017.

26th December 2017 is the last trading week of

2017. If we look at the returns given in last 1 years by the mutual fund here

are the toppers of 2017 in their respective categories:

1) Large Cap Funds:

2) Small Cap and Mid Cap Funds :

3) Diversified Equity :

4) Equity Linked Saving Scheme :

5) Balanced Funds :

Note that past one year performance is not the best gauge for analyzing the performance of these funds.

Source : moneycontrol.com

Linking Aadhaar to all mutual funds in one go

Linking Aadhaar to all mutual funds.

These days we are getting messages for all mutual fund

houses to link our Aadhaar to mutual funds.

All the mutual funds houses work either under CAMS or Karvy.

If we link our Aadhaar on these 2 sites it will be linked to all our mutual

funds investments.

Thanks

Saturday, December 2, 2017

Why STP is better than SIP?

I am writing this article to explain to you why STP which stands for "systematic transfer plan" is better than SIP (systematic investment plan) for equity mutual fund investment when you have a lumpsum amount in your bank account.

Suppose you have 1 lakh rupees in your account and you want to invest it in equity.

We have understand that investment in equity is subject to market risk and it is having high volatility but at the same time history has proven equity as the best form of investment option for human kind.

Understanding everything we know how SIP can save us from market fluctuation and it is the best means for a layman to invest in equity but what should you do if you have lots of funds in you account from a bonus or sale of property? Should you keep that amount in bank and slowly invest through SIP?

The answer is NO. Bank these days are giving only 3.5% return keeping huge amount in savings banks account will not be the wisest investment approach. Put the lumpsum amount in liquid fund.

These are the funds which invests in government securities with very short expires as a result they never go down and gives a approximate return of ~6%. Then start one or multiple STPs from liquid fund to equity fund. Simple!!

List of liquid funds to invest : http://www.moneycontrol.com/mutual-funds/performance-tracker/returns/liquid.html

Suppose you have 1 lakh rupees in your account and you want to invest it in equity.

We have understand that investment in equity is subject to market risk and it is having high volatility but at the same time history has proven equity as the best form of investment option for human kind.

Understanding everything we know how SIP can save us from market fluctuation and it is the best means for a layman to invest in equity but what should you do if you have lots of funds in you account from a bonus or sale of property? Should you keep that amount in bank and slowly invest through SIP?

The answer is NO. Bank these days are giving only 3.5% return keeping huge amount in savings banks account will not be the wisest investment approach. Put the lumpsum amount in liquid fund.

These are the funds which invests in government securities with very short expires as a result they never go down and gives a approximate return of ~6%. Then start one or multiple STPs from liquid fund to equity fund. Simple!!

List of liquid funds to invest : http://www.moneycontrol.com/mutual-funds/performance-tracker/returns/liquid.html

Subscribe to:

Posts (Atom)