HOW TO REPLY FOR INCOME TAX NOTICE U/S 143(1)(a).

Your return for AY 2017-18 bearing Ack. No. xxxxxxxxxx was taken up for processing and on verification it was found that it contains arithmetical errors/ incorrect claims/ inconsistencies with respect to Audit Report /Form 26AS and the same is indicated in the table annexed.

2. You are required to provide your response to this communication by electronic mode using your account on the e-filing website, wherein a link has been enabled showing the pending actions. If you agree with the differences indicated in the table annexed, a) either fully, or b) partially,

You may exercise your option of filing a revised return, so that the omissions in the return of income can be completely taken care of within the meaning of section 139(5).

3. However, you have also been afforded a facility in the e-filing portal to state the extent to which you are in agreement with the difference as indicated in the table. For the disagreed portion, please provide the amount and the reason for such disagreement.

Then do not worry here is a simple step by step process to reply for this kind of notice.

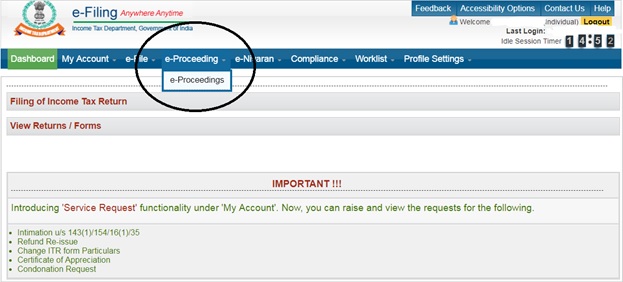

2. Click on e-Proceedings:

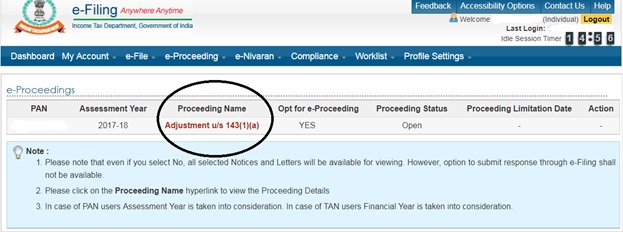

3. Click on proceeding name :

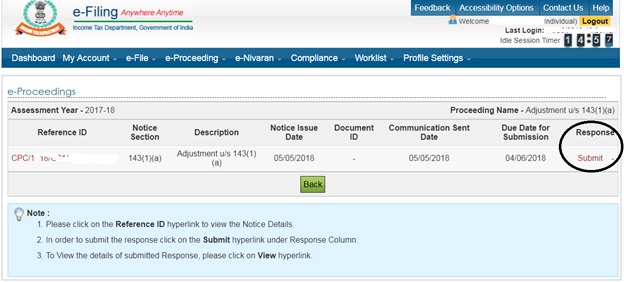

4. Click

on Submit link under Response header:

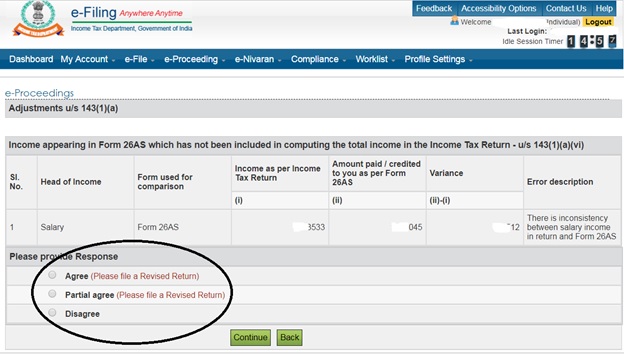

5. You will get 3 options “Agree”/”Partially Agree”/”Disagree”:

6. If you click “Agree”/”Partially Agree” you will

have to file revised ITR and give acknowledgement number here.

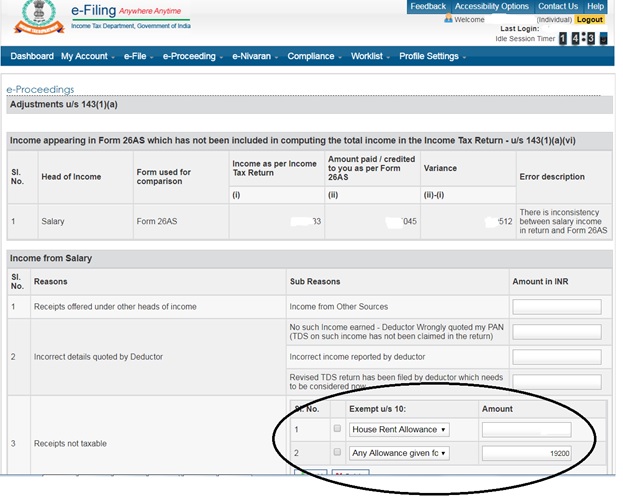

7. If you click “disagree” you are given below

form:

8. Enter

the reason and amount for discrepancy:

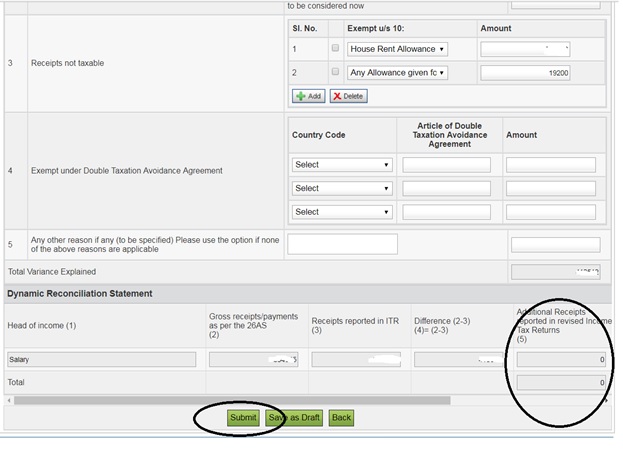

9. Make sure net tax payable is 0 else you have to

file revised ITR. Click Submit.

No comments:

Post a Comment